Entrepreneur and author Teneshia Warner shares a childhood story of being paid less because she was female, and being told that it would always be that way- by her own grandmother. Teneshia also shares her advice on how to handle the dream bullies and previews her new book.

Teneshia’s Money Story:

Teneshia Warner:

All right, so The Big Stretch, I am thrilled about my second book. As you just mentioned, I'm the founder of The Dream Project, and I was able to take a lot of the key learnings from speaking to over 180,000 dreamers, iconic dreamers, as well as my own story, and put it in a book format of a 12 week dreamers bootcamp.

Bobbi Rebell:

And I can tell you the book literally lays it out in very easy to follow steps and there's a lot of accountability in the book. We're going to get to that soon, but I don't want to hesitate to get to your money story, because this is kind of an epic story. There's a big twist, it has to do with your great grandmother and a lesson she taught you. But the lesson she taught you was not the one that she intended to teach you. Go for it.

Teneshia Warner:

All right, so my money story, it actually dates back until I was a young kid. I was in the third grade, so think I'm eight or nine. I had an idea that I wanted to work the summer over at my great grandmother's farm. She owned a farm with hundreds of acres of land. And my uncle, who was also very younger, he's only five years older than me, I went to him, and his name was Gerald. I said, "Gerald, I have an idea. I think I can convince our grandma, [Osi 00:03:43], to allow us to work the farm and pay us versus pay other people."

Teneshia Warner:

So he was down for it. And I went over to my grandmother and I pitched her on this concept. You should keep the money in the family, let Gerald and I work for you this summer. And so I landed us a job, Bobbi. And we were working the farm. We would get to work around 4:30 AM. I would go with my grandmother and Gerald would go with my great grandfather. And for my great grandmother, we would go and get eggs out of the chicken coop, we would clean the porches, we would pick fresh vegetables, we had to cook dinner. I mean it was a long, long day. And then as for Gerald, he was doing things in the field like picking corn, all types of hard labor things.

Bobbi Rebell::

But you're both working.

Teneshia Warner:

We both are not only working, we are working hard. At the end of the day we're exhausted.

Bobbi Rebell::

So then comes payday.

Teneshia Warner:

Yes. So we do this for about two weeks and payday comes. Prior to this, I didn't negotiate how much she was going to pay us, I was just happy to have a summer job. And so she gave us these envelopes, and I didn't want to be rude and open it in front of her.

Teneshia Warner:

So we got in the car and we went back home. And we open our envelopes. So Gerald tore his envelope open and out comes this money that's folding. And then I tear my envelope open, and coins drop out.

Teneshia Warner:

And so I'm looking, and I'm like, wait a minute, something's wrong here. Where's my money? There was no money, there was not folding money in there. And so I went to my mom and I said, "I need you to take me back over to my great grandmother, Osi's house."

Teneshia Warner:

So she took me back and I said, "Hey you, you must have made a mistake because I don't have any folding dollars and I only have coins, so you didn't pay me the right amount." And we kind of went back and forth. She told me she was very clear on the amount that she paid me. And I kept pushing, pushing.

Teneshia Warner:

And then finally she said, "You know what, Neshia." She called me Neshia. "I'm not going to pay you the same amount that I paid Gerald, because the world is not going to do that." She said, "No matter what, girls do not make what boys make, and I'm not going to start doing that." Yes. So it really pierced my heart.

Bobbi Rebell:

And this was a statement, not a discussion.

Teneshia Warner:

This was a statement, yes. It was like, the end. And so I was really, really courageous with what I did next, Bobbi. I put my hands on my hip, I looked at her in the eyes and I said, "If you're not going to pay me what you pay Gerald, I need you to know I quit." And I took off running because she definitely believed in the rod and she would have spanked me, but it was worth it for me to stand up for myself.

Bobbi Rebell:

And what did Gerald say?

Teneshia Warner:

So my dearest Gerald. Gerald felt sorry for me. However, Gerald continued to work and collected that check for the rest of the summer.

Bobbi Rebell:

Wow. And that folded money. And what did your mom say? And did you have any further discussions as you got older about this with any of the people involved?

Teneshia Warner:

So my mom, she's just awesome. I told her how I felt, and she told me that I did not have to go back and work there, that if I really wanted to quit, that I could. Hindsight looking back, I realized she really wanted to teach me a lesson, and she knew that that was going to give me an experience to stand up for myself and to actually demand my value, which leads me to, that's why it's my money story because one of my biggest lessons I took away from that, and that's, it's okay to demand your value and stand by that.

Bobbi Rebell:

And the amazing thing is, that was not the lesson that your great grandmother was teaching you.

Teneshia Warner:

Absolutely not.

Bobbi Rebell:

She is from a different era, and we love our grandmas, but that was not the lesson that we want to teach people today. What is your lesson for our listeners from that story?

“It’s ok to demand your value and stand by that.”

Teneshia’s Money Lesson:

Teneshia Warner:

So my lesson for your listeners is, if you are a small business owner, and or, if you're working in corporate America, there comes a time that you have to be extremely comfortable with what you bring to the table and the value that's associated with that, and willing to negotiate based on that value, and not compromising that.

Bobbi Rebell:

One thing in the book that I've asked you to talk about as your money tip, your everyday money tip is, how to do a dream detox specifically. If there are people in your life that are what you call a dream bullies, what do you do specifically to get rid of those people? Do you just ghost them? What do you do?

“When you have a dream and you have a big idea, it is important that you safeguard your dream.”

Teneshia’s Money Tip:

Bobbi Rebell:

One thing in the book that I've asked you to talk about as your money tip, your everyday money tip is, how to do a dream detox specifically. If there are people in your life that are what you call a dream bullies, what do you do specifically to get rid of those people? Do you just ghost them? What do you do?

Teneshia Warner:

Well, I definitely wouldn't say ghost them. Well, first, I think it's very important to know that when you have a dream, and you have a big idea, especially when you really originally get that idea, it's important that you safeguard your dream. So you have to become aware of who is in your circle.

Teneshia Warner:

Do you have a circle of dream champions? Champions reflect back to you the best of who you're becoming, they're going to reflect back to you the possibility that this dream can become a reality. And or, you have dream bullies. And dream bullies are those that are within our circle that potentially just cannot see the vision that you've been given for that dream. Sometimes your dream bully can be the people that are the closest to you, that actually love you the most, and they will actually try to protect you as you stretch to become more uncomfortable and to step outside of that comfort zone, you will find that you start to disrupt the comfort zone of sometimes the people that are really close to you.

Teneshia Warner:

Those individuals can sometimes want to protect you. Instead, they're becoming a dream bully. They're working against your vision. So for me, my best friend in the whole world is my grandmother. Not my great grandmother, but my grandmother. Her name is [Noretha Hearns and 00:09:24], and she is the biggest dream bully I've ever encountered.

Bobbi Rebell:

Oh my goodness.

Teneshia Warner:

And so I've had to learn, when I have a big idea, and I have a concept, I don't share those visions with my grandmother because she's not going to support me in having them turn out. So for the listeners, how do you do a dream detox and how do you protect yourself from the bullies? Well, number one, first you need to identify who they are. Second, you need to alter your conversations accordingly. That's not the place to go and share your next big idea, that's not the place you call where you want to know, do I continue to go or do I stop?

Teneshia Warner:

And so it's not about cutting out dream bullies completely out of your life. I don't want you sort of ghosting everybody and then saying Teneshia and Bobbi told you to tell everybody peace out. No, that's not what we're saying. However, I will say it's about becoming conscious, and aware, and protecting your ideas and your dreams accordingly. And it may mean altering your relationships with the person, especially as you're in a season of birthing a new dream. You may not find yourself hanging out with the old best friend where you know you guys used to gossip, or you weren't doing anything productive. Maybe that's not the person that you will be spending the majority of your time with in this new season of bringing your dream to reality.

Teneshia Warner:

One of the things that you talk about in your book also is doing a time audit. Absolutely. And, Bobbi, you and I were just talking. You talked about the fact that your book was in Cosmo, or in these business magazines. It wasn't that it just appeared there, but you did a lot of hard work. And so the hard work that goes into where you invested your time. So when you have this idea and this dream, you need to also do a time audit to say what time can you get back, and work that time for you and your dream.

“Your big idea and your dream, I can 100% bet it is not going to dwell within the zip code of your comfort zone. You are going to have to stretch beyond that, and it is probably going to take some radical action.”

Bobbi’s Financial grownup tips:

Financial grownup tip number one:

Bobbi Rebell:

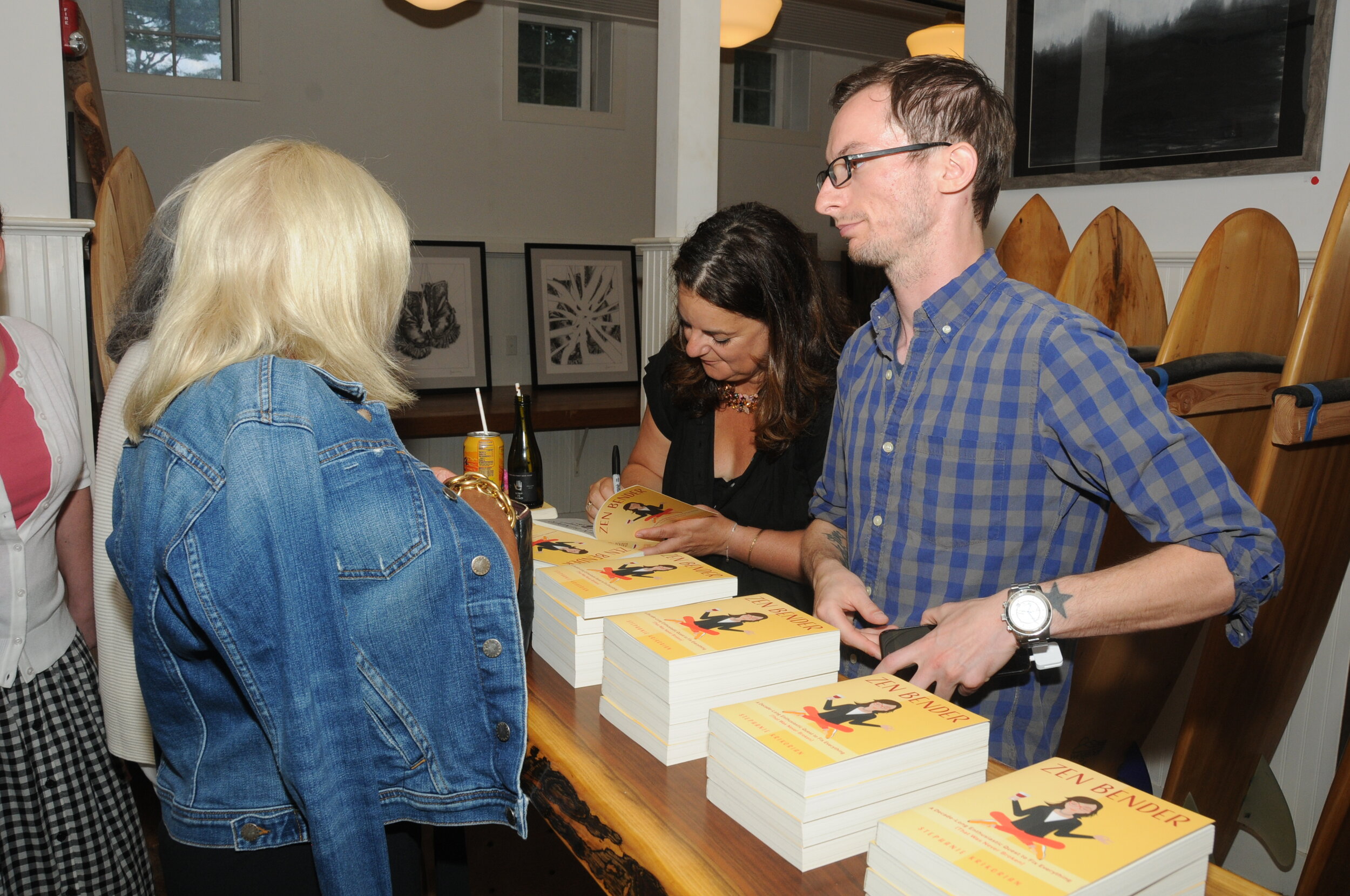

I totally related to tenacious experiences with dream bullies. I probably had more bullies, as she calls it, than supporters when I announced, a few years ago, that I was going to write a book with candid and personal money stories from super successful people while working full time in media, with three kids and a husband, and of course a dog.

Bobbi Rebell:

People were not only skeptical, some made really hurtful comments, and I know there was chatter behind my back at work. It was pretty bad. They really thought I would never pull it off. I had some supporters, don't get me wrong, but I wish I had Teneshia in my corner back then. But she's right, sometimes it's better to just not share your plans with them early on, especially if you kind of know they're not going to be supportive.

Financial grownup tip number two:

Do a time audit, kind of like those weight loss diaries where if you're write it down, you see what's going on, and that act in and of itself will change your behavior, and you'll have a better focus and be able to better allocate your time. You become more accountable. Don't necessarily though, share it with those dream bullies.

Episode Links:

Blinkist - The app I’m loving right now. Please use our link to support the show and get a free trial.

Teneshia’s website - egamigroup.com

Teneshia’s new book The Big Stretch

Follow Teneshia!

Instagram - @teneshiajwarner

Facebook - @teneshiajwarner

Twitter - @teneshiajwarner

LinkedIn - @teneshiajackson

Pinterest - @dreamcreative

Follow Egami Group!

Instagram - @egamigroup

Facebook - @EgamiConsulting

Twitter - @egamigroup

LinkedIn - @egami-consulting-group