Catherine Alford did everything right as she got ready to start a family with her medical student husband. But the unexpected and financially devastating cost of her newborn twins forced her to make some tough choices, that have changed her whole view of the world. Plus- her top negotiating tip and a preview of her new book Moms Got Money: A Millennial Mom’s Guide to Managing Money Like a Boss.

Catherine’s Money Story-

Before I became self-employed, before I gave birth to twins in 2014, I had chronicled my whole plan to become self-employed, super motivating. I saved this $10,000 baby fund. I saved all this money because I knew we'd have to move shortly after having the kids. I kept showing everyone the side hustles of this, the building up, so I was very organized and prepared which is sort of my way with money. But after I had the twins, after we moved, all of those things, having preemie twins, having some health problems with them, it pretty much drained everything I had saved and announced to thousands of people in the world on my blog that I had saved. And the twins needed this specialty formula, expensive formul. I told my pediatrician, "I don't know if I can afford it." It was like, $50 a can or something. And my husband was a student at the time, so it was just me, big time, brand new entrepreneur, mom of twins. I got this, and I did not have it. And so the pediatrician said, "Well, you can use this program called WIC which is for low-income mothers. It provides food and other things to make sure that mom and baby are well-nourished." I went and got them. And I didn't tell anybody because I felt such shame. I just felt like I was supposed to be this person helping other people with their savings, and I was supposed to be this motivating person. And I felt so ashamed that I couldn't buy this formula. And what made it worse is that I get the check. I've got these two babies with me in the grocery store, and I find the formula, do the whole thing, and the checkout lady is looking at the check, "What is this? I'm so nervous. I'm already feeling such shame. Got the two babies. I'm like, "It's a WIC check. You use it, and then I take the formula." She's like, "We've never seen one of these before. No one uses these at this store, and I don't know what to do." And so she gets on the loudspeaker in the grocery store and says, "Customer needs assistance with a WIC check." I'm already ready to just leave. I'm like, "Whatever. It doesn't matter." And in that moment, this dad behind me with two little kids get so pissed, he leaves all of his groceries on the belt, and he just storms out the store. So I start crying. The kids start crying. The manager comes over. We all made it to the car. All of us cried the whole way home, babies, me. And I think that was probably the lowest point for me, and my kids just turned seven. So it took me six or seven years to actually share that with the public.

Catherine’s Money Lesson-

I think the biggest lesson is even in those bleakest kind of bottom moments, don't give up. There can always be a comeback story. I could've asked for help. I have a whole chapter on the importance of vulnerability and telling people when you need help and even being vulnerable and sharing your successes with people too. But I am stubborn and super independent. I really wanted to make it on my own, wanted the business to work. And it just felt like such a failure for me, but I could have easily asked for help from a family member, from somebody, but I didn't. And I wanted to make myself suffer as if it was my fault, even though I had done everything right. So the experience really fueled me. I was like, "I don't want to do this again. I don't want to go through this again." So I really doubled down on my business after that. And by the time my kids were three, I was earning six figures for my business, and things got better from there. But it was really that moment that was like, "Look, we can't mess around with this business. Girl, you got sit down. You got to get going on this because we can't be in this checkout line again like this."

Buy your copy of Mom’s Got Money now!

Check out millennialhomeowner.com , a website to help millennial’s on their journey to buy a house. (Catherine’s on the team!)

Follow Catherine!

Instagram - @catherinecalford

Twitter- @catcalford

LinkedIn- Catherine Alford

Website- www.catherinealford.com

Follow Bobbi!

Instagram - @bobbirebell1

Twitter- @bobbirebell

LinkedIn- Bobbi Rebell

Website- http://www.bobbirebell.com/

Did you enjoy the show? We would love your support!

Leave a review on Apple Podcasts or wherever you listen to podcasts. We love reading what our listeners think of the show!

Subscribe to the podcast, so you never miss an episode.

Share the podcast with your family, friends, and co-workers.

Tag me on Instagram @bobbirebell1 and you’ll automatically be entered to win books by our favorite guests and merch from our Grownup Gear shop.

Full Transcript:

Bobbi Rebell :

I was watching this interview the other day with Nick Jonas. He was promoting his upcoming album and telling everyone about how he learned to make these cool designs in his homemade cappuccinos. And by the way, based on the picture that they showed, he's actually pretty good at it.

Bobbi Rebell :

And then he broke character. You could just see the change in his body language and his voice as he got honest. Nick Jonas says he is just so bored, and you know what? I believe him. I am too. I don't know. How about you? I would love to come in here and say that I have some magical solution. Sorry, but at least I can try to get all of us to break down our walls a little bit like Nick and maybe have a little laugh at everything?

Bobbi Rebell :

We take being a grownup really seriously, and that's for all good reasons, but we also need a break. And we need to give our friends and family a break.

Bobbi Rebell :

Grownup Gear is perfect for that. Who doesn't need a pillow that says, "You had me a debt free" with an adorable pig wearing shades. And let's be honest. A sweatshirt reading, "I can't believe I'm a grownup either" is really what we're all thinking.

Bobbi Rebell :

You can see more designs at grownupgear.com or on my website, bobbirebell.com. The merch makes great gifts for everything from graduations, engagements, bachelor and bachelorette parties, bridal showers, Mother's Day, Father's Day, and the most important holiday of all, today because we're all still here living our lives the best we can in spite of all the things.

Bobbi Rebell :

Go to grownupgear.com and be sure to check my Instagram, @bobbirebell1, for discount codes, and thank you for supporting this venture and for supporting the podcast.

Catherine Alford :

So she gets on the loudspeaker in the grocery store and says, "Customer needs assistance with a WIC check." I'm already ready to just leave. I'm like, "Whatever. It doesn't matter." In that moment, this dad behind me with two little kids gets so pissed, he leaves all of his groceries on the belt, and he just storms out the store.

Catherine Alford :

I start crying. The kids start crying. All of us cried the whole way home.

Bobbi Rebell :

You're listening to Financial Grownup with me, certified financial planner, Bobbi Rebell, author of How to Be a Financial Grownup, but you know what? Being a grownup is really hard, especially when it comes to money. But it's okay. We're going to get there together.

Bobbi Rebell :

I'm going to bring you one money story from a financial grownup, one lesson, and then my take on how you can make it your own. We got this.

Bobbi Rebell :

Hello, my grownup friends. The title of this episode is Public Money Shame at the Grocery Store.

Bobbi Rebell :

Now at first glance, you might think I was talking about guest, Mom's Got Money author, Catherine Alford. But the title doesn't refer to Catherine. It's actually meant to point to the dad who judged her, standing behind her at the grocery store, knowing nothing about her or her situation. Shame on him because Katherine's newborn twins were preemies. She needed a special formula that was crazy expensive. And so, yes, she needed help. And she had the humility and frankly, the common sense as someone responsible for two tiny humans to get the babies the help they needed, even if it meant asking for help.

Bobbi Rebell :

I'll leave it to Catherine to share more in our interview, and I'll be back with some very strong feelings about this other person later.

Bobbi Rebell :

But first, a quick check-in. Thank you for joining us for this episode of Financial Grownup. We share stories from accomplished financial grownups and the lessons from them, and then we wrap things up with the money tip we can all put to work to live a richer life.

Bobbi Rebell :

When I met Catherine for the first time in 2016, my book had just come out, and she asked me for advice because she had an idea for a book. Her twins were, I would guess, about two years old, and now they're seven. And she has published that book. I'm so truly and deeply proud of this woman, having witnessed just a fraction of what she's experienced and is now sharing.

Bobbi Rebell :

And for the non-moms out there, invest the time to listen to this story because as I said a few moments ago, the story isn't so much about Catherine. It's about all of us, including that dad who couldn't hit pause for just a moment to see the human being right in front of him and the money struggles that we choose not to see.

Bobbi Rebell :

I'm so grateful Catherine shared her story. Here is Mom's Got Money author, Catherine.

Bobbi Rebell :

Hello, Catherine Alford, my friend. You are a Financial Grownup. Welcome.

Catherine Alford :

Thanks for having me, Bobbi. I'm excited to be here.

Bobbi Rebell :

I am excited to share more about your new book, Mom's Got Money: A Millennial Mom's Guide to Managing Money like a Boss. Congrats on the book.

Catherine Alford :

Thank you so much. Been a long time coming, as you know.

Bobbi Rebell :

I do know. And I want to first do your money story. We'll get back to more about the book, but the money story I've asked you to talk about is from the book. And you're going to elaborate a little bit on it here, but I hope people will go back and read the full story in the book.

Bobbi Rebell :

It's a topic that is really uncomfortable. Very few people want to talk about, but we should because, I'm just going to guess, it's probably more common in different ways than any of us want to admit in public to the world, and you were very brave to do so.

Bobbi Rebell :

Tell us your money story, Catherine.

Catherine Alford :

Sure. Well, before I became self-employed, before I gave birth to twins in 2014, I had chronicled my whole plan to become self-employed, super motivating. I saved this $10,000 baby fund. I saved all this money because I knew we'd have to move shortly after having the kids. I kept showing everyone the side hustles of this, the building up, so I was very organized and prepared which is sort of my way with money.

Catherine Alford :

But after I had the twins, after we moved, all of those things, having preemie twins, having some health problems with them, it pretty much drained everything I had saved and announced to thousands of people in the world on my blog that I had saved. And the twins needed this specialty formula, expensive formula reflux, blah, blah, blah.

Catherine Alford :

I told my pediatrician, "I don't know if I can afford it." It was like, I don't know, $50 a can or something. And my husband was a student at the time, so it was just me, big time, brand new entrepreneur, mom of twins. I got this, and I did not have it.

Catherine Alford :

And so the pediatrician said, "Well, you can use this program called WIC which is for low-income mothers. It provides food and other things to make sure that mom and baby are well-nourished." I went and got them. And I didn't tell anybody because I felt such shame. I just felt like I was supposed to be this person helping other people with their savings, and I was supposed to be this motivating person. And I felt so ashamed that I couldn't buy this formula.

Catherine Alford :

And what made it worse is that I get the check. I've got these two babies with me in the grocery store, and I find the formula, do the whole thing, and the checkout lady is looking at the check, "What is this? I'm so nervous. I'm already feeling such shame. Got the two babies. I'm like, "It's a WIC check. You use it, and then I take the formula." She's like, "We've never seen one of these before. No one uses these at this store, and I don't know what to do."

Catherine Alford :

And so she gets on the loudspeaker in the grocery store and says, "Customer needs assistance with a WIC check." I'm already ready to just leave. I'm like, "Whatever. It doesn't matter." And in that moment, this dad behind me with two little kids get so pissed, he leaves all of his groceries on the belt, and he just storms out the store.

Catherine Alford :

So I start crying. The kids start crying. The manager comes over. We all made it to the car. All of us cried the whole way home, babies, me. And I think that was probably the lowest point for me, and my kids just turned seven. So it took me six or seven years to actually share that with the public.

Catherine Alford :

But that one made it in the book. It's still the one story in the whole book that gets me every time. I go right back there to the intercom every time I read that.

Bobbi Rebell :

What's the lesson from that? I mean, there are so many. There are so many lessons, I don't know where to begin. For you, for our listeners, what is the biggest lesson, I guess?

Catherine Alford :

I think the biggest lesson is even in those bleakest kind of bottom moments, don't give up. There can always be a comeback story. I mean, I could've asked for help. I mean, I have a whole chapter on the importance of vulnerability and telling people when you need help and even telling... being vulnerable and sharing your successes with people too.

Catherine Alford :

But I am stubborn, super independent. I really wanted to make it on my own, wanted the business to work. And it just felt like such a failure for me, but I could have easily asked for help from a family member, from somebody, but I didn't. And I wanted to make myself suffer as if it was my fault, even though I had done everything right.

Catherine Alford :

So the experience really fueled me. I was like, "I don't want to do this again. I don't want to go through this again." So I really doubled down on my business after that. And by the time my kids were three, I was earning six figures for my business, and things got better from there. But it was really that moment that was like, "Look, we can't mess around with this business. Girl, you got sit down. You got to get going on this because we can't be in this checkout line again like this."

Bobbi Rebell :

How did it affect your view of people that you now see that need help?

Catherine Alford :

So much compassion, and I have so much empathy. You just... you never really know what someone is going through. And I'm actually grateful for the experience because I think I have a lot more compassion.

Catherine Alford :

I actually... I tried to buy two cans of formula for a mom behind me in line. I like really want to do this now. It was funny because I was finishing checking out, and the mom behind me had two cans of formula. I'm like, "I'll take her formula too." And she said, "Oh no, I'm buying it with WIC. Don't worry about it." And I was like, "I know about that. I used that with my twins." And I always try to help moms when I see formula on their checkout line instead of leave like the dad behind me.

Catherine Alford :

So I think even really successful people have these down moments, especially in our industry and the kind of jobs we do. We don't really like to talk about the bad stuff. Educators about personal finance talk about all the good stuff. All you see is the million dollar business. Even when you've had a lot of good runs, you can still have the bad moment and come back from it.

Bobbi Rebell :

And we learned a lot about that in the pandemic. Many people just lost clients overnight, or the clients hit pause, and there was so much uncertainty in what we do and in what so many people do. Thank you for sharing that.

Bobbi Rebell :

Let's move on to your money tip because this has to do with valuing yourself, and it particularly applies to moms in the context of your book, but it really could apply to so many people that do things that aren't necessarily valued for what they should be.

Bobbi Rebell :

What is your money tip?

Catherine Alford :

Well, this one is for all the mamas out there. I really like to encourage moms to know their approximate hourly rate. As moms, we feel so guilty. All of us know we need help. We need Mary Poppins. We [inaudible 00:12:02] fairy godmother. We all need so much help. But we resist. We're like, "We don't really need the housekeeper. Do we really need a babysitter for that thing? I could just take the kids to my hair appointment."

Catherine Alford :

It's like, "No, you need to know your hourly rate so that you can eliminate that guilt about outsourcing." As long as you make more per hour than what you're paying the person helping you, then there should be no guilt. If you're a stay-at-home mom, you could maybe do a little side hustle or something to help you out, or if you're a working mom, make sure you calculate that rate, and that way you, don't have any guilt.

Bobbi Rebell :

Fun fact, LinkedIn recently added Stay-at-Home Mom as a job category.

Catherine Alford :

I saw that. That's cool.

Bobbi Rebell :

Why so long?

Bobbi Rebell :

Anyway, I want to talk about your book, Mom's Got Money: A Millennial Mom's Guide to Managing Money Like a Boss, and I'm going to put you on the spot. In the book, you talk about cringe-worthy purchases when you advise moms to go and look at things that are maybe not necessarily needed in terms of the things that they spend money on.

Bobbi Rebell :

What is your most cringe-worthy purchase, Catherine Alford?

Catherine Alford :

I remember when I first started running ads from Facebook for my business really early on in my business, I pretty much did not have the money to spend, or it was most of what I had earned that month. And I remember spending almost $1,000 on Facebook Ads to run webinars [inaudible 00:13:22] and nothing converted and nothing sold. It was in two days, the money just disappeared like I was gambling with it.

Catherine Alford :

Now, 10 years later, I know a lot more about Facebook Ads, but just so many choices in business like that. You have to kind of try things. But that was a painful one.

Bobbi Rebell :

All right, one more thing. One thing I love in the book is that you talk about the fact that you would love negotiating, and you've taught your children too. What is your number one tip for negotiating successfully?

Catherine Alford :

My number one tip is to be nice. I think people think negotiating is all about being really aggressive and making sure you get your words in, and you make sure you say the number first. I am just so nice when negotiating, and I'm really complimentary about how much I really want to work with the person, how awesome they are. But I have to have a certain number, and it's such a bummer just because I have all these time constraints, it really has to be this number to make it work. So I am the nicest negotiator.

Bobbi Rebell :

All right. Tell us where people can find out more about you and the book.

Catherine Alford :

You could find out more about me at catherinealford.com. I'm always on the 'gram under @catherinecalford. And on my website, my readers can go to the homepage, and they can download a Mom's Got Money workbook which has a ton of stuff from the book and a lot of great things to think about and for moms to sort of jumpstart their money journey.

Bobbi Rebell :

Perfect. Thank you so much. This has been wonderful, so much great advice, and I hope everyone picks up the book.

Catherine Alford :

Thanks for having me, Bobbi.

Bobbi Rebell :

Here we go, my friends. Financial Grownup Tip Number One: Do as Catherine now says, not as she did. Ask for help from people who love you. Catherine didn't take her own advice to ask for help from the people that care about her, her closest friends and family. As she said in our interview, she has a whole chapter on vulnerability. But Catherine, like many of us, wanted to make it on her own and felt that asking for help, even in these unforeseen and very extreme circumstances, would have been perceived as a failure. She was afraid of letting people down. She now knows so much better.

Bobbi Rebell :

I get it. I bet you do too. It's a really hard thing to ask for help from people that are cheering you on because they think you've got this.

Bobbi Rebell :

Well, try to at least have the discussion. It's okay to say that things have changed. You might feel so much relief, just not hiding your secret.

Bobbi Rebell :

Financial Grownup Tip Number Two, and this is a big one: Do not presume you have any idea what is going on with the person ahead of you in a grocery line who may be using coupons, government assistance, whatever. And don't presume you won't be in a financially vulnerable position in the future. We should all know better after the past year.

Bobbi Rebell :

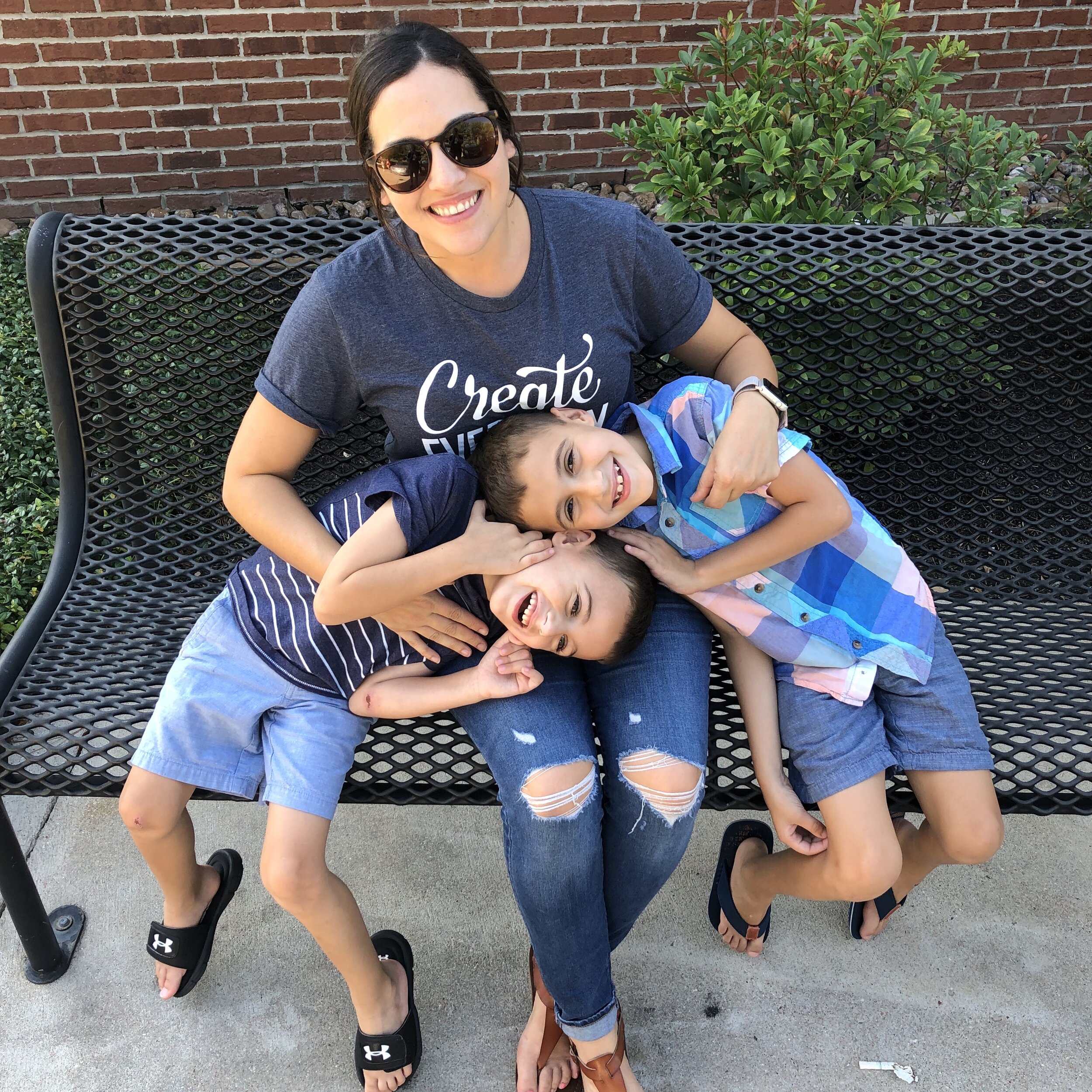

I also want to share a fun moment that we experienced, we shared, I should say, over social media Catherine and I had soon after we recorded this interview. Her books arrived, and she shared the big unboxing with her kids on her Instagram account. It made me remember my own unboxing moment from 2016 with my now 13-year-old, and guess what? I found the video, and I was able to share it. It was great.

Bobbi Rebell :

The best part of writing a book or any big achievement, frankly, is seeing people you love, and especially your kids, light up with pride. Please think about that the next time you feel guilty working towards a goal or having to spend more time than you would like away from your kids and loved ones.

Bobbi Rebell :

On that note, a couple of big announcements. April is Financial Literacy Month, and thanks to the generosity of our Financial Grownup guests who have new books out and their publishers, I am giving out books to all of you to celebrate. DM me on Instagram at @bobbirebell1 and just write, "I'd love a book by a Financial Grownup," and we'll send you one.

Bobbi Rebell :

Next, I want to spend more time getting to know you. Please join me and my Financial Grownup money experts on our weekly Clubhouse chats. They happen Friday at 1:00 PM Eastern in the Money Tips for Grownups Club. DM me on Instagram if you need invitation for Clubhouse or any help in figuring out how to get there. I am @bobbirebell1.

Bobbi Rebell :

And finally, Mother's Day is coming up. I have some great gift options at grownupgear.com. I hope you take a moment to check it out. The podcast is free to you, but the revenue from Grownup Gear helps to support and pay for the podcast, so thank you for your support.

Bobbi Rebell :

Go pick up a copy of Mom's Got Money for yourself or for the moms in your life, and big thanks to Catherine Alford for helping us all be financial grownups.

Bobbi Rebell :

The Financial Grownup podcast is a production of BRK Media. The podcast is hosted by me, Bobbi Rebell, but the real magic happens behind the scenes with our team. Steve Stewart is our editor and producer, and Amanda Saven is our talent coordinator and content creator, so that means she does the show notes you can get for every show right on our website and all the fantastic graphics that you can see on our social media channels.

Bobbi Rebell :

Our mission here at Financial Grownup is to help you be at your financial best in every stage of life. And this year, we want to help you get there by giving away some of our favorite money books. To get yours, make sure you are on the Grownup list. Go to bobbirebell.com to sign up for free.

Bobbi Rebell :

While you're there, please check out our Grownup Gear shop and help support the show by buying something to express your commitment to being a Financial Grownup.

Bobbi Rebell :

Stay in touch on Instagram @bobbirebell1 and on Twitter @bobbirebell. You can email us at hello@financialgrownup.com. And if you enjoyed the show, please tell a friend and maybe leave a review on Apple Podcasts. It only takes a couple minutes.

Bobbi Rebell :

Join us next time for more stories to help you live your best grownup life.