Money Tips for Self-Made Bosses

Learn the best advice, hacks and lessons to be your own self-made boss from top small business owners with authors Jackie Reses and Lauren Weinberg

Follow Jackie Reses and Lauren Weinberg!

Lauren’s Twitter - @WeinbergLauren

Jackie’s Twitter - @jackiereses

Jackie’s LinkedIn

Lauren’s LinkedIn

Website - https://www.selfmadeboss.com/

Jackie and Lauren’s book - Self-Made Boss

Follow Bobbi!

Instagram - @bobbirebell1

Twitter- @bobbirebell

LinkedIn- Bobbi Rebell

Website- http://www.bobbirebell.com

Did you enjoy the show? We would love your support!

Leave a review on Apple Podcasts or wherever you listen to podcasts. We love reading what our listeners think of the show!

Subscribe to the podcast, so you never miss an episode.

Share the podcast with your family, friends, and co-workers.

Tag me on Instagram @bobbirebell1 and you’ll automatically be entered to win books by our favorite guests and merch from our Grownup Gear shop.

Full Transcript:

Bobbi Rebell:

Hey, grownup friends. This episode is sponsored by UNest. Start investing in your most important asset, your kids, with UNest. Soon you will also be able to give the gift of crypto. Join the UNest legacy wait list and get early access entry into giveaways and much more. Visit unest.co for more information.

Lauren Weinberg:

If you're in the food business, he talks about using a smaller plate when you're taking pictures of food, what time of day, how to capture the best light. He really goes into a lot of specific details, because if you think about social channels and all these places where people are getting information or where they're viewing content from business owners, the better you can put your brand out there with photography and how you portray things, the more likely you are to connect and breakthrough.

Bobbi Rebell:

You're listening to Money Tips for Financial Grownups with me, certified financial planner, Bobbi Rebell, author of Launching Financial Grownups, because you know what? Grownup life is really hard. But, together, we got this.

Bobbi Rebell:

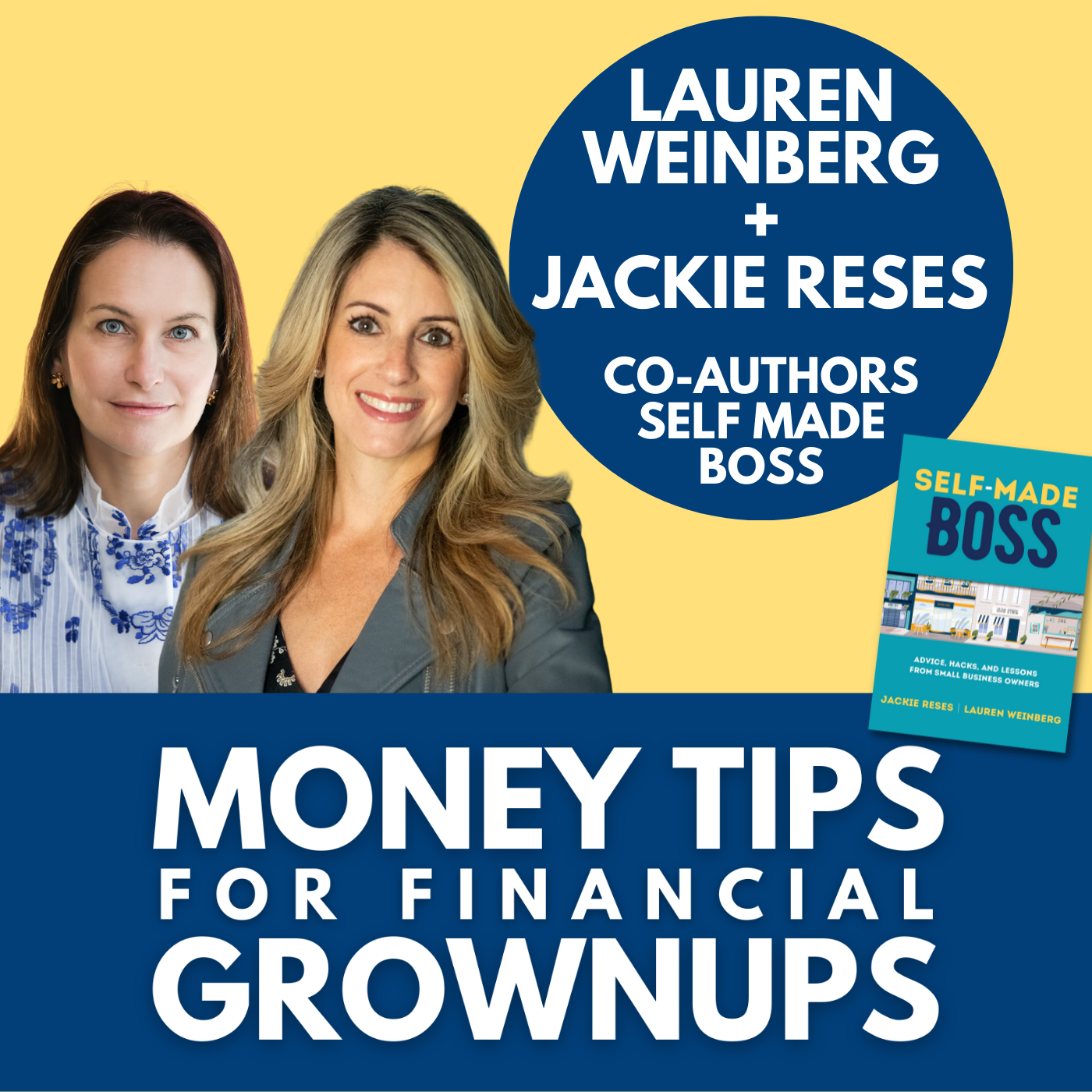

The money is in the details. If you want to succeed in business, my friends, wise words from Lauren Weinberg. She is the co-author of a new book, Self-Made Boss, that had me both smiling and taking notes as I read it. The other author is a longtime friend of mine, Jackie Reses. We went to Penn together, where we were also Tri Deltas.

Bobbi Rebell:

Jackie and Lauren met while working at Yahoo, and then worked together at Square, where they spent a lot of time with small business owners and entrepreneurs. Now they have come together with their first book, hopefully one of many, Self-Made Boss: Advice, Hacks, and Lessons from Small Business Owners.

Bobbi Rebell:

In our interview, we cover how businesses can leverage technology to connect more with customers, a great story about a pet-grooming business that you will definitely want to hear, upping the ante on the employee experience, creating an employee culture ... Super important these days when there's a lot of competition for workers, so you want to keep the good ones ... and how to set your company up to pass on to the next generation, although you also need to figure out if you even should.

Bobbi Rebell:

Here are Jackie Reses and Lauren Weinberg. Jackie Reses and Lauren Weinberg, you are both financial grownups. Welcome to the podcast.

Jackie Reses:

Thank you for having us.

Lauren Weinberg:

Yes, thanks for having us.

Bobbi Rebell:

Congrats on the book Self-Made Boss: Advice, Hacks, and Lessons from Small Business Owners. By the way, this is extra special because Jackie is a dear friend of mine going back to our days at University of Pennsylvania, where we were roommates and even, dare I say, Tri Delta sorority sisters. Oh my gosh. All right, before we get into the advice that you have for our listeners, you both met working at big companies. Tell us more about how you met and how this book was born.

Jackie Reses:

Sure. So we had the pleasure of meeting at Yahoo. We were both executives who ran the company. We then moved from Yahoo to Square. Lauren, I'll speak for you right now and just keep going for a second, and then you can introduce yourself.

Jackie Reses:

So Lauren is the chief marketing officer of Square. So wow, wow, wow. Incredible. And I ran banking and lending at Square and also the people team. And so, we had the benefit of working at a company that focuses on empowering small businesses and helping them start, run, and grow.

Jackie Reses:

And so, the idea was born out of listening to customers through the millions of Square sellers across the country, particularly in a pandemic, when we saw how much trauma was happening in the small business market. We understood some insights around how small businesses build community and learn and we thought this book would be an incredibly powerful guide to help them build their business.

Lauren Weinberg:

Yeah. I don't have too much to add to that other than, yes, Jackie and I met at Yahoo. We also were both New Yorkers who moved to California. So we shared that journey together of just moving our families across the country. We spent time in California walking around, because there was really nothing else you could do during the pandemic. We thought there's just this void of information.

Lauren Weinberg:

We also had the insight that more people than ever were starting their own businesses. That was true in 2020, where we saw more new business formations, and then again in 2021, where you have the great resignation where people aren't just leaving their jobs to sit home all day. They're leaving their jobs to go and start businesses.

Lauren Weinberg:

We thought, wow, anytime that there's these downturns in the economy or things are changing is a time where we tend to see a lot of innovation and new starts. And so, we thought the timing for putting a book like this out there with this kind of advice would be a good moment for it.

Bobbi Rebell:

Well, it was definitely a good moment, and you have a very optimistic tone, Lauren. I love that. Self-Made Boss also is a book ... Even though it is definitely a business book, it is very practical, it is very specific, but it's driven by personality and it is a book that is joyous. There's a lot of fun stories in here. So I want to ask each of you, what was the funniest story in the book where you just couldn't help but smile?

Jackie Reses:

Yeah, I'll start. One of the things we really enjoyed about the book is that it's written through the eyes of small business owners, and each chapter is a business chapter like HR, finance, hiring, operations, and logistics, legal matters. But each chapter is told through the eyes of four or five small businesses in each chapter and also a handful of experts in each chapter.

Jackie Reses:

There's one in particular that I really enjoyed, and the entrepreneurs' names are Keith and Patricia Miller from Pampered Pooch Playground and Bubbly Paws in Minneapolis. You listen to Keith and Patricia, and it was Keith who I spent the most time with, talk about how they build their team at a grooming shop ... Grooming shops, because they now have a few, in Minneapolis. He had incredible insight in how he focuses on fun and teamwork and creating an environment that feels safe for the dogs, safe for dog customers, and also safe for his employees.

Jackie Reses:

And so, I loved his ideas. One really simple one in building trust was he took a video of the dog getting groomed while it was getting groomed. He saw so many advantages in this idea. From a dog owner's point of view, they could see how their dog behaved during grooming, which could be a trying time for some dogs. The dog obviously felt safe because they were going to be streamed to their owner. For his employees, they felt safe so that they could also show their work. If anything went wrong, they could show what happened. It was a great experience. They could show that as well.

Jackie Reses:

And so, it's kind of like one of those things that you would never think of, but it's a really interesting business hack that he created in the context of his grooming store.

Bobbi Rebell:

I love that it's using technology to make it more human and more ... I don't know what you call it with the animal, but you know what I mean. It's connecting people. Lauren, do you have a fun story?

Lauren Weinberg:

I would say that Germanee G. is somebody that really stands out to me, because she epitomizes this idea of following your passion and your dreams. So she had this great job, corporate job, at Gap and she left that job to go become a stylist. She now splits her time between Atlanta and LA. I think just hearing about her saving up her money and just getting ready to take that leap of faith is just really cool, because to me it really, I think, just epitomizes that entrepreneurial spirit that we try to capture in the book and just how she really went for it to go pursue her dreams.

Bobbi Rebell:

And also so relatable because so many people do have these dreams. One thing in the book that I liked is that nothing was too small. You get into some very tiny decisions, but they are very important decisions. So can you share what the most overlooked thing, or one of the overlooked things, that many business owners forget to pay attention to that's really important, it moves the needle?

Lauren Weinberg:

I'll talk about two things to start with. I think one is just the entire look and feel of your business. I think thinking about your business from the notion that every touchpoint that somebody has with your store, what does your window look like? What does it look like when you walk through the door? If you have an online business, your website, your logo, your presence, every interaction that somebody has with your brand is a chance for them to make an impression and form a relationship with you. And so, I would just say all of those details really matter.

Lauren Weinberg:

And so, thinking about them from the very beginning of your business is really important. Then along those lines, we talked to Aundre Larrow in our marketing chapter and he is a photographer. He gave all these like very specific tips on how to take great pictures.

Lauren Weinberg:

So if you're in the food business, he talks about using a smaller plate when you're taking pictures of food, what time of day, how to capture the best light. He really goes into a lot of specific details, because I think if you think about social channels and all these places where people are getting information or where they're viewing content from business owners, the better you can put your brand out there with photography and how you portray things, the more likely you are to connect and breakthrough.

Lauren Weinberg:

So I thought the tips that he provided in there were really very specific, very detailed, and extremely actionable. Like don't take pictures outside in the middle of the day when it's sunny, but do take pictures inside when there's indirect sunlight. Just really practical tips that anyone can use on their own.

Jackie Reses:

I thought some of the financial advice was really helpful also, and just tiny decisions you might make at the very beginning of starting a company. For example, don't combine your business account and your personal account in terms of business accounts. A lot of small business owners, when they start to make it easy on themselves, they conflate the two. But there are a lot of downstream effects that could impact their business just by that one simple decision.

Jackie Reses:

And so, now there are lots of places, particularly online, where you can open up an online business account for free, and then get a lot of the technical tools that help support lots of other analytical decisions you can have.

Jackie Reses:

And so, the reason why you don't want to combine the accounts is if you ever want to get credit, it's hard to take apart your business account and your personal account. When you have to deal with taxes, it makes it more complicated. You're going to spend a headache's worth of time dealing with taxes. You might need to position your company to raise money at some point in the future. It just looks sloppy. Then you clearly have to do a separate accounting. Then you might also need trades and have to do trade invoicing and things like that.

Jackie Reses:

And so, you're going to have to start separating because they're going to want to get credit. They're going to want to see your different elements of your business operating independently.

Bobbi Rebell:

What was the number one hack each of you learned from the self-made bosses that you interviewed, ideally something that you guys ... Even though you have a big, strong history in small business which people can read about in the book, what did you learn?

Lauren Weinberg:

I think Jackie talked about Keith Miller and Bubbly Paws. I think that they were really ahead of their time when it came to just thinking about culture and employee benefits for small business owners. I think a lot of business owners are contending with this fact now, like how do we retain employees?

Lauren Weinberg:

Keith was bringing cupcakes for employees on their birthdays. He was doing engagement surveys. He was offering employees mats to stand on so that their feet were more comfortable throughout the day. I think in a lot of ways, those are really simple things, but not always things that small businesses have front and center when they're thinking about their employee experience.

Lauren Weinberg:

So that was definitely one that I thought, wow, he had the hiring and culture part of the business down in a way that I think a lot of businesses are really trying to get their head around in the moment.

Jackie Reses:

Yeah. Pete Stein, the oyster farmer that you had talked about, he hacked software. So he wanted to optimize his operations and he used bus software in order to build his own optimized routes. And so, it doesn't have to be something super complicated. You can go out and try to find a proxy for what you're trying to do.

Jackie Reses:

My comment before was go find a free online business savings and checking account. In this case, he optimized his utilization. And so, if you're really creative about some of these systems, you can do it in a cheaper way if you need to and have it done more quickly. I think that kind of creativity is great.

Bobbi Rebell:

All right. Last question. We talk a lot on this podcast about generational wealth. What is your advice to families who want to pass a small business to the next generation? Because it is complicated.

Lauren Weinberg:

It is complicated. I think a couple of things. One is to make sure that you have family members that want to take on your business. We heard a lot from business owners that just didn't have anybody to pass their business on to. So I think that's something that getting your family members involved in, making sure that the interest is there.

Lauren Weinberg:

Then when it does come time to transition, I would say give up some control. I think one of the things we learned from a lot of the people that we interviewed in the book that come from multi-generational businesses is that when the next generation could come in and they were given more free reign to think about how they would change the business operation, that that really helps the business evolve.

Lauren Weinberg:

So one example is with Acme Smoked Fish. That was the company that I talked about with my roommate from college. It's fourth generation. Her brother came in and said, "We really need to upgrade how we think about manufacturing. We have a smoked fish company." At the time, it felt like a huge risk to them, and it ended up becoming the thing that really helped propel their business into the next phase of growth.

Lauren Weinberg:

I think the same thing is true with Pesso's Ice Cream, where they were really starting to think about using data. They used to have 132 flavors and they realized they don't need 132 flavors, that they could have 30 flavors and that those 30 flavors are the most popular, that really cuts down on the amount of time that they spend then producing ice cream flavors that are less popular.

Lauren Weinberg:

So I would say make sure that you, a, have the people there that have the interest. Then give them the room to do things in a little bit of a different way, which does require giving up some control, which is hard to do.

Bobbi Rebell:

Jackie, by the way, oh, your parents had a small business that you did not take over.

Jackie Reses:

Oh me? Yeah.

Bobbi Rebell:

Oh yeah.

Jackie Reses:

No, I definitely was not taking over my family's small business. I think I'm the only person in my family to not work for myself. I did come from a small business family, and I appreciated some of the upsides and downsides of working with people that you can't fire and they are part of your family.

Jackie Reses:

And so, the message that I would add to this ... And I think about Jonathan Sciabica from Sciabica Family California Olive Oil and Gourmet Foods. Literally his grandfather and great-grandfather began the business with information they had pulled coming from Italy. The insight from him was to think about rules for how you're going to work together. Think about who decides what and how do you operate.

Jackie Reses:

I think that was really good advice he gave us so that you could try to minimize the ambiguity in how you make decisions and how you operate together. And so, people had their roles. Sometimes in family business, that can be incredibly challenging because you have, I'll call it, sloppy decisions. But where you don't make sloppy decisions and you're very specific about who does what, who decides, it can help alleviate some of that family tension.

Bobbi Rebell:

Excellent advice. Thank you both for joining us. Where can people learn more about you guys and Self-Made Boss?

Jackie Reses:

Well, they absolutely should go to our website, selfmadeboss.com. They can go onto Amazon or any independent book seller, if they prefer that, and look up Self-Made Boss. Hopefully they will enjoy the book.

Bobbi Rebell:

Thank you both.

Lauren Weinberg:

Thank you.

Jackie Reses:

Thank you so much for having us.

Bobbi Rebell:

So many great stories we couldn't get to. So even if you are not a small business owner, read this book, just for the entertainment value and the amazing stories these self-made bosses share with Jackie and Lauren.

Bobbi Rebell:

So what resonated with you in the interview? DM me on Instagram, @bobbirebell1, or on Twitter, @bobbirebell. Please share this podcast on social media, or just tell a friend, so we can grow the Financial Grownup community.

Bobbi Rebell:

I also want to thank those you who have reviewed my new book Launching Financial Grownups wherever, maybe Amazon, maybe Goodreads, and have shared it on social media. Please let me know when you do through all the social channels, and I would love to thank some of you. I'll surprise you with some Grownup Gear merch, which, by the way, you can check out at grownupgear.com to celebrate all of the adulting moments in your life.

Bobbi Rebell:

By the way, if you are looking for someone to speak to your company or your school or your parent group, please get in touch. Just go to my website, super easy, bobbirebell.com, and click on the Work with Me tab, or you can also get a Grownup Gear discount by signing up for the newsletter.

Bobbi Rebell:

Big thanks to Jackie Reses and Lauren Weinberg, authors of Self-Made Boss. Pick up a copy. Thanks to both of them for helping us be financial grownups.

Bobbi Rebell:

Money Tips for Financial Grownups is a production of BRK Media, LLC. Editing and production by Steve Stewart. Guest coordination, content creation, social media support, and show notes by Ashley Wall. You can find the podcast show notes, which include links to resources mentioned in the show as well as show transcripts by going to my website, bobbirebell.com.

Bobbi Rebell:

You can also find an incredible library of hundreds of previous episodes to help you on your journey as a financial grownup. The podcast and tons of complimentary resources associated with the podcast is brought to you for free, but I need to have your support in return. Here's how you can do that.

Bobbi Rebell:

First, connect with me on social media, @bobbirebell1 on Instagram and @bobbirebell on both Twitter and on Clubhouse, where you can join my Money Tips for Grownups Club. Second, share this podcast on social media and tag me so I can thank you. You can also leave a review on Apple Podcasts. Reading each one means the world to me. And you know what? It really motivates others to subscribe.

Bobbi Rebell:

You can also support our merch shop, grownupgear.com, by picking up fun gifts for your grownup friends and treating yourself as well. Most of all, help your friends on their journey to being financial grownups by encouraging them to subscribe to the podcast. Together, we got this.

Bobbi Rebell:

Thank you for your time and for the kind words so many of you send my way. See you next time and thank you for supporting Money Tips for Financial Grownups.