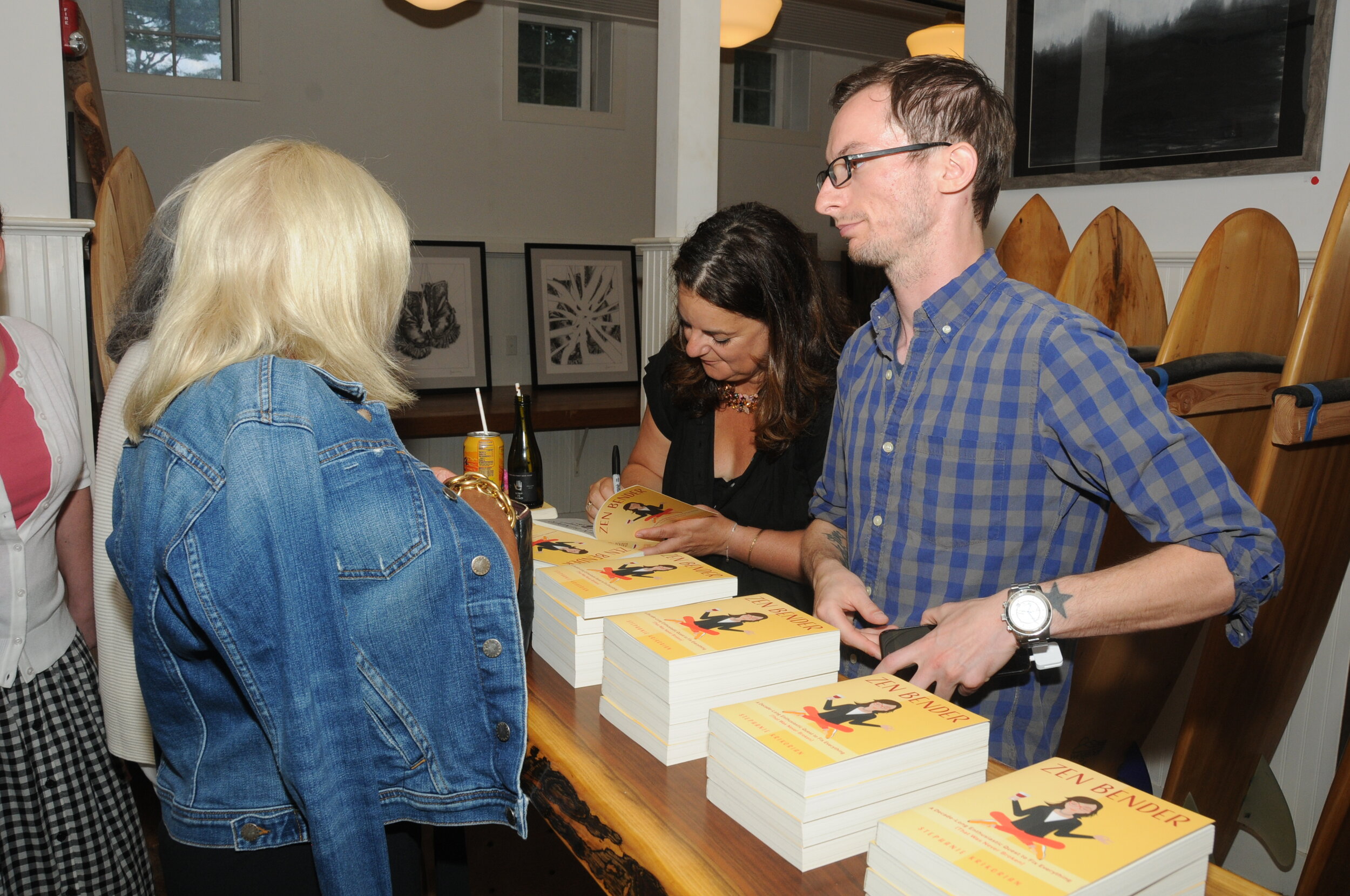

Ghost writer Stephanie Krikorian trusted a financial planner with her investments after a big layoff a decade ago. But years later discovered blind trust was costing her, and learned to read the paperwork, and take grownup ownership of her money strategy.

Stephanie's money story:

Steph Krikorian:

So, basically, I get laid off and I did two quick things. I refinanced while I still had a paycheck coming in, because rates were down and they hadn't been for awhile. I thought that was a smart thing to do. Secondly, I went to this financial planner and merged several 401ks, because I had been at several jobs and never really paid much attention to it. I always put in the max that I could, et cetera. But I thought, "This will help me move it, and then I can focus on finding a job or starting a business, whichever I'm going to do."

Steph Krikorian:

I remember meeting with this financial planner and asking a very specific question, "How are you paid?" My understanding when I left that meeting, and I interview people for a living, so I feel fairly confident I was given a certain answer and didn't make that mistake, but maybe I did, my understanding was the payment for the financial planner was based on money I made, so that if I made 10%, the financial planner was paid a percentage of that. So, I do all these things, and I am on my own little austerity program. I'm doing a single pump of shampoo. You can read about all the crazy things I did to not waste money while I was trying to, you know, make sure I didn't overspend. ,I was trying to stay on my budget. I invested. I knew I had to save. Even when there was no money coming in, even though I cut everything else out, I scraped together a certain amount of money.

Steph Krikorian:

So, in the meantime, I start going on the Zen Bender, because I start reading self-help books. I've reinvented myself. I start reading self-help books. I start getting obsessed-

Bobbi Rebell:

This is all because you're ghostwriting a lot of them too, so you're really immersing yourself in your material.

Steph Krikorian:

That's how it started. I really was immersing myself in the material, because everybody has a book idea, and then they say, "Oh, it's like the Suze Orman of such and such or the Marie Kondo of such and such." So, I was reading for research, but as I read, I also got a little obsessed, because I said, "Oh my God. There's all these fixes out there. I must have all these holes in my life to fill. I'm single. I'm thick around the middle, because everyone wants to lose a few pounds. I'm trying to figure out my career." So, I started grasping at all these things a little more than necessary, as per the research.

Steph Krikorian:

So, I take my eye off the ball of what I think I had set up with the financial planner, and I spend hoards of money on Reiki, and rainbow healers, and dating coaches. You know, I could've basically probably gone to law school instead and done something productive. But all of this time I think, "You know, I've made my budget. I'm following the rules. I'm being careful." But somewhere in all that mishmash, kind of the point of the Zen Bender was I lost a little bit of confidence. I stopped trusting my gut and I kind of took my eye off the ball of the important things and ceded a lot of power to these ... you know, this dating coach who's telling me, "You've got to wear high heels and have shiny hair in order to find a husband, because he'll think you're fertile, and he'll want to marry you."

Bobbi Rebell:

Right. And probably very expensive heels too.

Steph Krikorian:

[inaudible 00:06:24] I got $200 a pop, but if you do five, then of course X,Y,Z is going to happen. The doors will open up. I had started treating my business like a business. Even though it's writing, I formed an LLC. I have a lawyer. I outsource things like copy editing, because I wanted to only do the work that was mission-critical. So, I was making enough money. It wasn't like I was on my credit card doing this stuff. You know? There were lean years the first couple of years. Then I started getting on my feet and I started making enough money.

Steph Krikorian:

Somewhere in there I have a call from my financial planner. Also, in fairness, if I step back and look at it, she gave me a couple of pieces of advice which were, "Sell all your stock from your first job," which was General Electric stock, which at the time was not a good suggestion, and, "Dump this apartment, even at a loss." I disregarded both pieces of advice. I was not going to dump that apartment at a loss. I was going to make my payments, and I was going to save it, that investment. So, I didn't take that warning sign, you know? That should have made me a little nervous, and it didn't, because I knew better. I'd worked in financial news, like you, and I knew that wasn't right. Every year I'm putting together the maximum I can scrape in and put in, but nothing's really moving in the fund. I'm in one of those funds as you age, you know, with the term and the end.

Bobbi Rebell:

The target date fund, which sometimes have double fees. Sometimes those can be very expensive.

Steph Krikorian:

Right. It didn't seem to be doing a lot, and I thought, "Oh, it must just be the time, you know. Whatever." So, we have this call and she suggests, since I've reached a certain milestone, she explains there's this, you know, almost like a fund of funds with these various ETFs in the same thing. It sort of ages as you go and it's really something to consider. I said, "Okay. Great. I guess so. Sure." She said, "And the fee is so much less. It's almost half,| or whatever. I say, "Oh, what's the fee been generally, because it shouldn't ... you know, we haven't made a lot of money, so it couldn't possibly be very high." She tells me the percentage, and I do the math, and I get furious.

Steph Krikorian:

I'm like, "Wait a minute. You're charging more out of my fund than I'm depositing every year. You should have seen that." You know, she said, "Well, I don't keep track of who's putting in more or who's not." I'm like, "That's your single job. That's like your only job, to be ... Maybe you should've stopped and said, 'Hey. I don't think you need to be in here. Just go to Fidelity and buy a fund.'" I was mad at her, but honestly I was more mad at myself, because the one thing I probably should have spent the time on was understanding what was going on there. But I got so lost in the haze of all the chaos and life change that was happening, that I trusted the professional to handle it, and I don't think ... She didn't do anything negligent or anything like that. She did what she told me she would do. It's just I didn't double check. I think you have to stay on top of these things, because the single most important thing is your money, period. It really is.

“Nobody reads the fine print. So you have to do your own annual or semi-annual check in and now I do. I check very rigorously all my financial statements. ”

Stephanie’s money lesson:

Steph Krikorian:

Double check, double check, double check, and then quarterly, when you have those check-ins, check, and maybe you're smarter than the experts. Maybe if you're in a single fund, investigate the other ways to invest in that single fund, so that you don't pay the load that you're paying a financial planner,` who has much wealthier clients to make money off of.

Bobbi Rebell:

Was she a fiduciary? Do you know? Was she a CFP? Was she a fiduciary?

Steph Krikorian:

Yup. Mm-hmm (affirmative).

Bobbi Rebell:

Really?

Steph Krikorian:

Yeah. It was a big firm and all. She wasn't doing anything wrong. She did her job.

Bobbi Rebell:

And she informed you. You just didn't hear I guess is what you're saying.

Steph Krikorian:

I misunderstood at the beginning and I was an early client.

Bobbi Rebell:

You're a financial journalist.

Steph Krikorian:

I know.

Bobbi Rebell:

Oh my goodness, Stephanie. What hope is there for everybody else?

Steph Krikorian:

I know, and I wonder. I was an early client of hers, and she was just starting out. I liked her, because she was woman and she was new, and people were giving me a chance, and I gave her a chance. I still don't regret that, but I think, you know, these things aren't transparent. You can't tell how much you pay. In fairness to anybody, it's hard to tell what percentage you're paying in these things. So, I think you have to ask those questions regularly, because things also change, and nobody reads the fine print. So, you have to do your own annual or semi-annual check-in, and now I do. I check very rigorously all my financial statements. I check my bank account to see ... You know, my bank account got hacked. If I didn't check as frequently as I did, I would never have known. So, you-

Bobbi Rebell:

Oh my goodness.

Steph Krikorian:

It did. Yeah. They had my name. They had my bank account. Must've been off a piece of paper or a bill. They were trying to get in there. They didn't get anything. But, so, you have to always check. Nothing to do with your money should ever be on autopilot, even paying your bills. You know, you can miss a bill, because autopilot is not the way to go, and that's for your financial planning and your daily accounts. You got to keep a tally.

“Walking solves all my problems… It helps creatively, it helps anxiety.. and saves some money. ”

Stephanie's everyday money tip:

Steph Krikorian:

So, you can get really caught up into these things. The average price for any of these sessions is $200. It's very easy to get-

Bobbi Rebell:

For what? I'm sorry. $200 for what?

Steph Krikorian:

Like Reiki, the astrologist, acupuncture. $200 seems to be the going rate of 2019, and buying five packs is very easy to get caught up. I would say this. Try anything, because there's a placebo effect or you find it inspiring. Try anything once. Don't buy the five packs. Just try it and see, and then step away and think of it. Don't get caught up in it. But more importantly, what I found, after all of the sessions, and all of the coaches, and thousands of dollars on a dating coach, I'm still single.

Steph Krikorian:

All the diets I tried and paid for and I think of how much per pound I've spent trying to lose the same 5, 10 pounds. Go for a walk, and then go for another walk, and then walk for more, longer, longer, longer. Walking solves all my problems, and it took me ... I knew that at the beginning, and then I didn't figure it out until the end, but it helps creatively. It helps anxiety. It does the same trick as some of this other stuff does, and it helps you work out, and it's good for your health, and so do that. That's my suggestion. Save some money. Do everything that you want to do, but just once in a while. Don't go on a Zen Bender, like I did, and hit it all hard, all at once, all the time.

Bobbi Rebell:

Amazing advice, and it's so true about walking. I get all my best ideas when I'm walking. It's also a great way to socialize, instead of going somewhere and spending money on food that will cost you money and weight.

Steph Krikorian:

What was the scariest thing to write? Oh, a lot of it was scary. It set out to be a book on humor, you know, a humor book on all these crazy things I tried, and then as I wrote it, I'm like thinking, "Well, why did I do that?" I think a couple of things, quickly, how much weight has held me back in life. You know, we all wish we were a little thinner I think. I don't know. I can't speak for everybody.

Bobbi Rebell:

Me.

Steph Krikorian:

I think-

Bobbi Rebell:

I'm raising my hand.

Steph Krikorian:

Exactly. And we all wish that we could drop a few pounds, and I spent a little bit too much time obsessing about that. That was sort of disappointing, and I was surprised I was able to put that on the page, because I really don't like to talk about it. I think being single, you know, I kind of likened the dating at ... I'm 50 now, but this whole book took place in my 40s. It's like shopping at Marshall's or T.J.Maxx. Everything is picked over. It's like seconds right now. So, that was a lot for me to talk about. You know, I had a hard time with that.

Steph Krikorian:

The realization I came to through writing and through discussing it is that after doing the Marie Kondo, I Marie Kondo'd, the living crap out of my house, including my freezer, did the doors open up? I don't know, but I learned to say no to things that didn't bring me joy. I don't think that was her intent in the book. I think that was, as interesting as ... It wasn't a hard to write about that, but it was an interesting learning experience for me that that takeaway kind of came through the process of trying to be funny about folding my socks, rolling my socks a certain way, that all of a sudden I realized, wow, I have a hard time saying no to things. Now, I'm a little better at it.

Bobbi Rebell:

We're all working on that. I think that's a big theme these days is sometimes it's okay to just decline an invitation, even if you don't have a conflict. Just say, "I'm sorry. I can't make it," and don't elaborate.

Steph Krikorian:

Exactly.

“After doing the Marie Kondo.. I learned to say no to things that didn’t bring me joy.. that takeaway kind of came through the process of rolling my socks a certain way that I realized I have a hard time saying no to things.”

Bobbi’s Financial grownup tips:

Financial grownup tip number one.:

Buy what you want if you want to be trying things. That's always all good. But when Stephanie talks about buying the five packs, that applies to pretty much any upsell that you get in life. Yes. You do get a better price per item, but you also get more items than you want or need.

Financial grownup tip number two:

If you aren't sure that you understand how someone controlling your money gets paid, keep asking until you are beyond 100% sure. Stephanie is educated and smart and was literally writing about money for her job, but she made assumptions that were not correct.

As a financial grownup, I love that she takes ownership that maybe she didn't understand what she thought she did. It can happen to any of us, if it can happen to Stephanie. Read, and reread, and then, as Stephanie recommends, go do regular check-ins, as she now does, and of course be careful with automation. It is a great tool for regular bills and such, but that doesn't mean you shouldn't be checking as well. How are you doing on this front? Do you understand how people or companies that hold your money ore paid? Is free really free if there are maybe commissions or fees in there that you may not know about. Maybe they're disclosed in very tiny print, because if something is truly free, well, then how is the company making money? You need to ask what is going on on the other side.

Episode Links:

Blinkist - The app I’m loving right now. Please use our link to support the show and get a free trial.

Stephanie’s website http://stephaniekrikorian.com/

Stephanie’s book ZenBender

Follow Stephanie!

Instagram - @stephiekrik

Facebook - @skrikorian

Twitter - @stephiekrik

LinkedIn - @stephaniekrikorian