Millennial parents still like to tap the Bank of Mom & Dad

The Bank of Mom & Dad is busy these days.

Millennials with kids of their own say they received $11,011 in financial support or unpaid labor, on average, from their parents in the past year, according to a recent study by TD Ameritrade.

All told, that adds up to $253 billion worth of financial assistance.

Read More

For millennials, adulthood now defined by financial freedom

Oct 10 For millennials, feeling like an adult may no longer be about starting a family and buying a house, but rather landing a job and not asking mom and dad for allowance anymore.

A new Bank of America Better Money Habits report, released Oct. 6, found "financial independence" was the top priority of about 40 percent of the 18-26 year olds they asked to define adulthood.

Read More

Before a career break, millennials need a money game plan

Until a month ago, Andrew Lampert was moving up the career ladder in New York City as a pricing manager at an auto parts company.

Now, national parks are what Lampert, 28, and his girlfriend Elise Murphy, 24, call home.

“The high cost of New York City can make it seem impossible to get by without an income and money on top,” Lampert said. “I’m staying in national parks for free, cooking on an open campfire – no rent, no cable, no utilities."

Read More

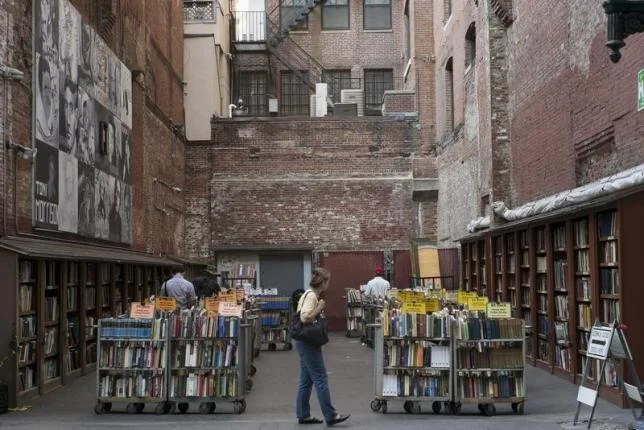

Reading into the millennial book-buying boom

Nearly a decade after electronic readers revolutionized how people read books, paperbacks and hardcovers have become cool.

"It is like a hipster movement to get back into reading," said Trish Caudill, manager of Books-A-Million in Corbin, Kentucky. "It's almost cult-like."

Read More

How social media makes millennial moms splurge

Remember those days when one of a mom's biggest challenges was getting out of a store without buying a toy for a screaming child?

While online shopping may eliminate in-store tears from kids, the Internet is prompting more millennial moms to make expensive online impulse purchases.

According to BabyCenter.com, 53 percent of moms feel overwhelmed trying to create the perfect life for their children. Almost half of those mothers, some 46 percent, have gone into debt as a result.

Read More

Net worth should not be a mystery to millennials

Ignorance is not bliss when it comes to one big number for millennials: their net worth. The vast majority of millennials (73 percent of those 18 to 34) have no idea what they have versus what they owe, according to a new survey from Harris Poll conducted for online money manager Personal Capital (personalcapital.com).

Read More

Millennials face debt - and denial

Debt may be a drag for millennials, but apparently not as much as cooking their own dinner. A survey from Citizens Bank found that fewer than half (47 percent) of millennials, those in the 18-35 age group, who are college graduates, would be willing to limit their online food delivery in return for reducing their student loans.

Read More

Invest and chill: Why millennials are such cool investors

Ian Wishingrad may only be 30 years old, but he already considers himself an investing veteran. So when the market began to swoon in early 2016, he kept his cool. It certainly helped that Wishingrad had someone to hold his hand. He works with a financial adviser to diversify the assets he has accumulated as he expands his creative marketing agency, Bigeyedwish.com.

Read More

Millennials spend big for Super Bowl fun

Sasha Amini is planning quite a spread for Sunday's Super Bowl. The 26-year-old, who works in sales at a financial company in McLean, Virginia, will spend at least six hours in his backyard smoking a smorgasbord of meats, including brisket and ribs, to feast upon during the match up between the Denver Broncos and the Carolina Panthers.

Read More

Why millennials want to quit their jobs

Twenty-eight year old Margaret Davis was making nice money as a writer in the legal department of a big pharmaceutical company in New York. She liked her coworkers and enjoyed the job on a day today basis except it was not going anywhere.

Read More

Why are millennials tapping payday loans and pawn shops?

David, 31, was in a pinch. He was building out a second location for his family's jewelry store in Queens, New York and running out of cash. He turned to a local pawn shop for financing to finish the construction, a decision he now regrets.

Read More

Millennials' charity drive: passion

At age 22, fourth-grade teacher Jessica King is already a charity veteran. The recent University of Pennsylvania graduate, with a degree in civic communications, started volunteering when she was 15, as a swimming teacher to special education students.

Read More

Make room for millennials in the kitchen this Thanksgiving

Etana Flegenheimer is upping her Thanksgiving budget this year. The Seattle-based search engine optimization specialist is having friends and family over. She is looking forward to a relaxing evening, visiting and watching football. Flegenheimer, 28, plans to buy her turkey at Whole Foods, instead of the cheaper one at Safeway. All told, she expects to spend about $200 on her Thanksgiving meal.

Read More

Millennials with benefits: keeping workplace options open

Kurtis Ofori was thrilled to start his new job writing grant applications at green energy startup Dawan Global in New York City. In addition to health insurance, Dawan Global offers the holy grail of benefits for young people: tuition reimbursement. Ofori, who is working toward an MBA, receives as much as 100 percent of his tuition on a sliding scale from his employer.

Read More

Millennials reaching middle age and starting to earn real money

Millennials are starting to earn real money. The oldest of them are pushing 35 years old, an age that is considered by some to be – OMG – middle age. In previous generations, they would be fully independent grownups. But these days, the cord cutting seems to be limited to televisions.

Read More

For college grads, 75 is new 62 for retirement planning

The numbers are not adding up for recent college graduates counting on a comfortable retirement. New data from NerdWallet.com, a financial information website, suggests young people, on average, will work 13 years longer than today's typical retirees.

Read More